March 12, 2018

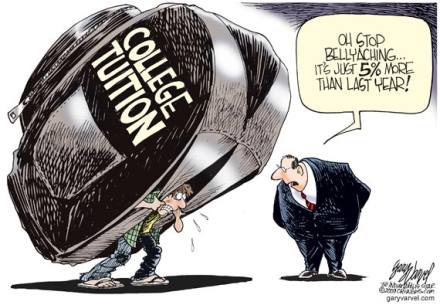

I regularly take students to university campuses for tours. During our visits, we like to go to some of the prominent departments of the university and speak to the faculty. Talking to faculty helps the students get excited about all of the opportunities in academe. Recently though, the tours have been focusing more on Rock Walls to climb, Yoga classes at the New Recreational Center, on-campus Coffee shops, Brazilian Churrascarias (steak houses), Pools with Lazy Rivers, etc. Millions of your dollars are being spent on, what I like to call, the Country-Clubification of campuses, all in the interest of competition to attract your student.

Tenure is a common practice in colleges that is intended to promote quality education and academic freedom by assuring that a professor cannot be fired without just cause. While tenure assures the academic freedom within the classroom, it has created a laissez fair work ethic. In large state Universities, your freshman students may never see a professor. Instead your student will be instructed by an upperclassman that may or may not speak English. It is common to have a Graduate Assistant as the face of large freshman classes. Where are the professors? Like Waldo, no one seems to know where they are? As tenure continues to protect unengaged professors, the costs will continue to rise.

The primary reason for the real estate crash in 2008 was that people were able to obtain financing for homes, even if they didn’t have the ability to pay them back. In order to help Americans own a home (part of the American Dream), the US government subsidized real estate mortgages such that all income levels could purchase a home, even if they couldn’t afford it. What? Are any of us surprised that didn’t work!

Guess who’s at is again! Now the US government is subsidizing millions of student loans without proof that the students will ever be able to pay it back. To comfort the tax payers, Federal Student Loans are not forgivable in bankruptcy, for now. In 2014, the dollars collected from Federal Student Loans are greater than any corporation in the US, including Exxon Mobile, Apple, Ford Motor Company, etc. The Student Loan bubble is more than $1 Trillion. Tax payers beware! We have another bail-out coming…

I’d love to hear you thoughts on the rising cost of college. Leave you comment below.

January 21, 2026

en talking with families about paying for college, scholarships usually come up fast. And while it’s true that scholarships can make a big dent in college costs, they can also be a little confusing and definitely time-consuming if you don’t know where to focus. At Class 101, we see it all the time. Students are […]

Read More >

December 8, 2025

Smart Financial Strategies for Students and Families For many students, earning a college degree is a life-changing milestone, but the financial burden that comes with it doesn’t have to be. With tuition costs rising each year, it’s important for the families we work with to plan ahead and make smart decisions to reduce student debt […]

Read More >

November 19, 2025

Every fall, high school Juniors in Bloomington and across the country take the PSAT/NMSQT. It’s a test that does more than just prepare students for the SAT. It’s also the qualifying test for the National Merit Scholarship Program, one of the most prestigious academic honors a high school student can achieve. At Class 101 Bloomington, […]

Read More >